[ad_1]

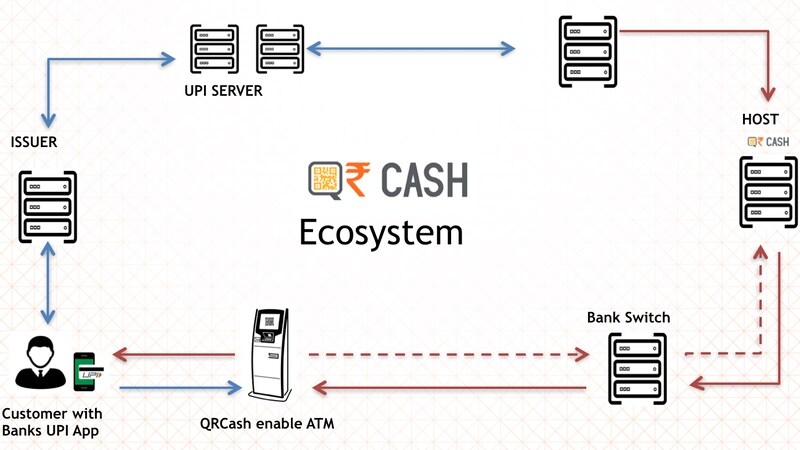

When anyone says UPI, you tend to think of person-to-person payments, or paying online, or sometimes even paying retail stores offline. But what if you could use UPI to withdraw cash from ATMs? Mumbai-based company AGS Transact Technologies has come up with a technology that does just that. Instead of using an ATM card to withdraw cash from an ATM, you need to use your phone to scan the QR code on screen and enter your UPI PIN on the phone. The ATM will then dispense the amount you asked for.

The catch is that AGS is awaiting an approval from NPCI for this technology, but the company told Gadgets 360 in an interview that the approval is expected in the coming months. AGS is already in the business of making ATM machines, maintaining them, and via a subsidiary called Securevalue India Limited, it also offers cash management for these ATMs.

Here’s how the new feature works — you go to an ATM and select withdraw cash via UPI. After that you enter the amount you wish to withdraw. The ATM machine will show you a QR code and then you switch to your smartphone. You can then scan the via the UPI app on your phone, enter an amount to withdraw, enter the PIN, and complete the transaction. The ATM machine will then dispense the cash you need.

Ravi Goyal, chairman and MD at AGS Transact Technologies, said implementing it won’t be a big challenge because it’s compatible with most current ATM machines. It requires a software update to enable this feature on ATMs. “There were a lot of options to implement UPI. The one we have implemented does not need any hardware changes at the ATM which is the key,” Goyal said.

“There could be QR code generation on your phone and you scan on the ATM. Then you need to install scanners in the ATM,” Goyal says, while talking about other ways they had considered implementing UPI cash withdrawals. “Various options were available but I think this is the most cost-effective from the implementation perspective,” he adds.

While it does sound cool to use UPI to make cash withdrawals as opposed to using the clunky interface that most ATM machines have, who is this really for? “We have been working for a few months on this. A lot of banks, let’s say India Post (payments) bank have not issued any cards. All their customers are on QR codes. It’s a challenge for them to withdraw money from ATMs. There is a use case,” Goyal explains.

AGS claims banks have shown interest in implementing this, but obviously nothing can progress until the NPCI approval arrives. Another challenge for this will be adequate promotion of the feature. Yes, this will allow you to withdraw money from your ATM without using a card, but the big challenge is to let people know that this is possible. AGS is hopeful that banks will do the promotion, but even if that happens, it will be interesting to see if the feature takes off.

[ad_2]